When it comes to booking a flight, travel insurance is often the last thing on your mind. But it should be one of the most important considerations when making travel arrangements. Choosing the right travel insurance for your next flight is essential for peace of mind and financial security. Whether you’re an 18 year old student or an experienced traveler, this guide will help you understand what to look for when selecting the perfect travel insurance policy for your next flight.

Determine your coverage needs: Before searching for travel insurance, consider your unique circumstances and decide what type of coverage you need

Before you start searching for the right travel insurance, take a moment to think about your unique circumstances and determine what type of coverage you need. Are you traveling alone or with a group of friends? Do you need to cover expensive items such as cameras or laptops? Are you looking for a policy that covers medical expenses or lost luggage? Do you need to insure your flight or other travel arrangements? These are all important questions to ask yourself when selecting the right travel insurance policy. It’s also important to consider the length of your trip. Some policies are designed for trips lasting up to 30 days, while others are more suitable for extended travel. As a 21-year-old student, you need to make sure you find a policy that meets all your needs.

Consider the length of your trip, where you will be travelling, and the activities you plan to do.

If you’re planning a trip, it’s important to consider the length of your trip, where you’ll be going, and what activities you plan to do. For example, if you’re a student going on an exchange program for a semester, you’ll need a longer-term travel insurance policy that’s tailored to your needs. On the other hand, if you’re just taking a weekend getaway, a one-time policy may be more suitable. When travelling, you should also consider the destination and activities you plan to do. For example, if you’re going on a skiing or snowboarding trip, you should make sure your policy covers winter sports and any medical bills you may incur in case of an accident. Additionally, if you’re travelling abroad, make sure your policy covers medical costs and repatriation in the event of an emergency.

Review the coverage options: Different travel insurance plans may offer different coverage options

Choosing the right travel insurance for your next flight can be a tricky task. When reviewing the coverage options, there are a few key factors to consider. Different travel insurance plans may offer different coverage options, so it’s important to make sure you understand the coverage of the plan you are considering. You may want to look for coverage for lost baggage, medical expenses, trip cancellation and interruption, and even accidental death and dismemberment. It’s also important to look at the exclusions, so you understand what may not be covered by the policy. With so many options, it’s important to do your research and understand the details of each policy to make sure you get the right travel insurance for your next flight.

Look for policies that offer the right mix of coverage for your specific needs.

When picking a travel insurance policy for your next flight, it’s important to make sure you’re getting the right coverage for your specific needs. Look for policies that include coverage for medical emergencies, emergency medical evacuation, trip cancellation or interruption, lost or stolen luggage, and emergency cash transfers. You should also consider what activities you’ll be doing on your trip and make sure the policy covers any potential mishaps that could occur. For example, if you are going on an adventure trip, you may want to look for a policy that covers extreme sports or any dangerous activities you are planning on participating in. With the right coverage, you can ensure you’re protected in the event of an emergency and enjoy your trip without any worries!

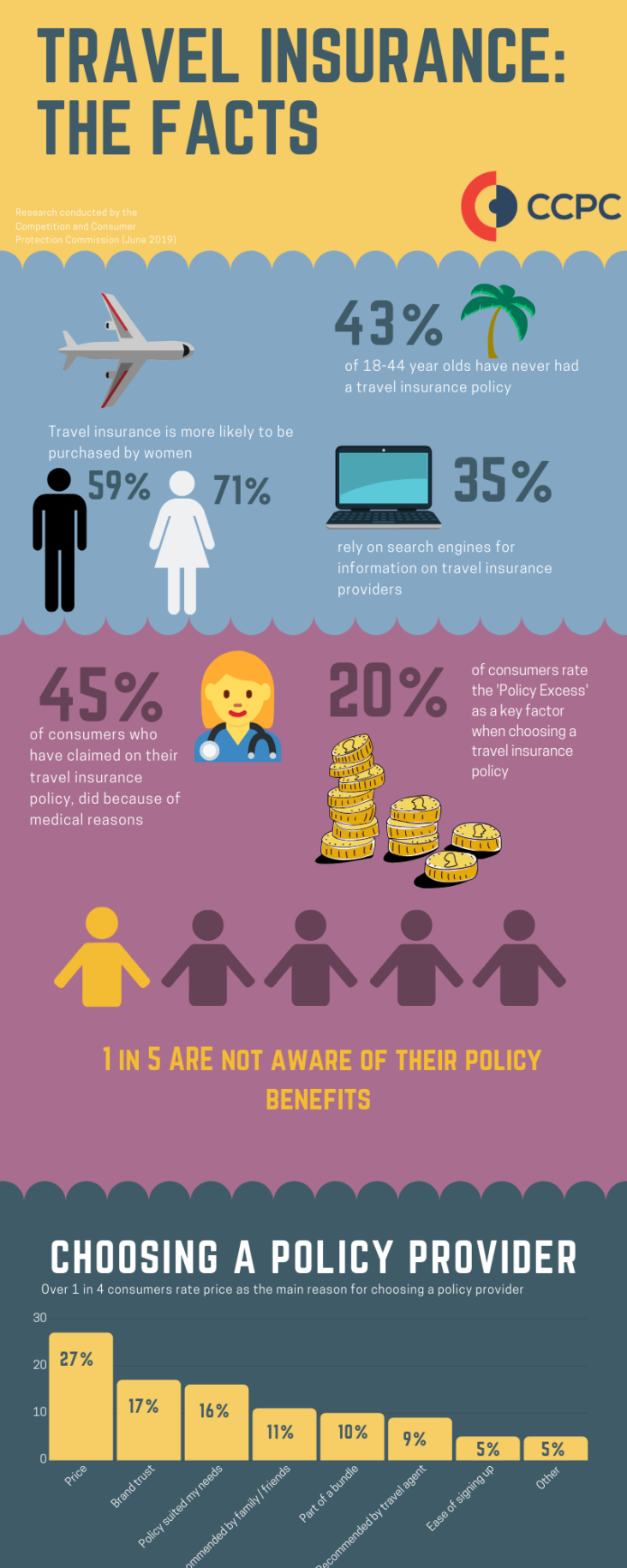

Compare plans and providers: Compare travel insurance policies from different providers

When comparing travel insurance plans and providers, it’s important to think about what kind of coverage you need. Make sure to look for policies that include coverage for medical emergencies, flight cancellations, and lost luggage. You should also compare the cost of different plans, as well as the level of customer service you can expect from each provider. Do your research and read reviews to make sure the provider you choose is reliable and trustworthy. Finally, consider any extra benefits or discounts that may be available with specific plans. With careful research and comparison, you can find the right travel insurance plan for your next flight.

Look at the coverage limits, exclusions, and costs to make sure you are getting the best deal.

When choosing a travel insurance policy for my next flight, it’s important to look at the coverage limits, exclusions, and costs to make sure I’m getting the best deal. I have to do my homework and read the fine print to make sure I’m covered for the things I’m most likely to experience on my trip. The coverage limits are important to consider, as it’s essential that I’m properly covered for any losses. The exclusions are also important to pay attention to, as there might be certain items that aren’t covered by the policy. Lastly, it’s important to compare the costs of different policies to make sure I’m getting the best value.

Read the fine print: Make sure you understand the terms and conditions of the policy before purchasing

When you are looking for travel insurance it is important to read the fine print before you buy. Don’t be fooled by the flashy offers and big claims. Make sure you understand the terms and conditions of the policy. Pay close attention to the details like what is covered, the level of coverage, how much it will cost and how long it is valid for. Ask yourself if the coverage is worth the cost and if it suits your needs. Also, look out for any exclusions or special conditions. Knowing exactly what you are paying for will help you make an informed decision.

Read the policy documents carefully

When it comes to getting travel insurance for your next flight, it’s important to read the policy documents carefully. That way, you can make sure you’re getting the right coverage for the right price. Reading through all the fine print can be confusing and time-consuming, but it’s worth it in the end. Make sure you understand what’s covered and what’s not so you don’t get stuck paying for something you weren’t expecting. Don’t be afraid to ask questions if something isn’t clear. As a 21-year-old student, I always take the time to make sure I’m getting the best deal for my money before I sign on the dotted line.